Australian Ecology overruled by ASIC

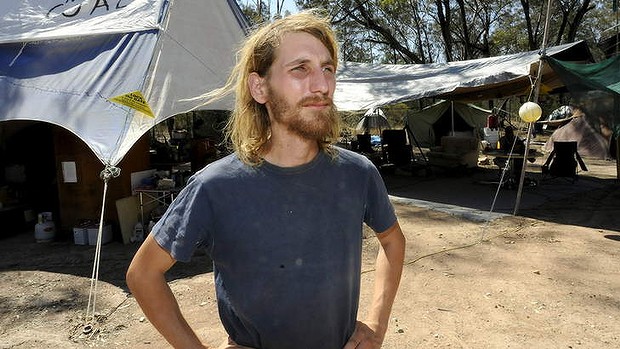

Environmental Protestor, Jonathon Moylan,

who put himself on the line to save Leard State Forest from greedy Whitehaven Coal

set to bulldoze koala habitat into extinction

[Source: ‘Time to flex shareholder muscle’, 20130119, Canberra Times,

^http://www.canberratimes.com.au/federal-politics/time-to-flex-shareholder-muscle-20130118-2cz10.html

Environmental Protestor, Jonathon Moylan,

who put himself on the line to save Leard State Forest from greedy Whitehaven Coal

set to bulldoze koala habitat into extinction

[Source: ‘Time to flex shareholder muscle’, 20130119, Canberra Times,

^http://www.canberratimes.com.au/federal-politics/time-to-flex-shareholder-muscle-20130118-2cz10.html

It was not Whitehaven Coal, but the Australian corporate regulator, Australian Securities and Investment Commission (ASIC) who tried to imprison a civil protester to jail in defence of market gambling.

ASIC Chairman Greg Medcraft

ASIC Chairman Greg Medcraft

<< Jonathan Moylan, 26, was today sentenced to 1 year 8 months imprisonment, but subject to release immediately on a 2 year good behaviour bond following a hearing at the Supreme Court in Sydney. 150 supporters held a vigil in support of Moylan outside the court.

ASIC used Orwellian language of defending ‘mum and dad’ investors, disguising the fact that mining companies like Whitehaven Coal are predominantly foreign-owned.

The miners, along with the superannuation industry and the ”big four” banks, have done a remarkable job popularising the idea that all Australians own a share of all companies thanks to their super. By that logic, anything that hurts any company is ”bad” for Aussie mums and dads. And that is, of course, the impression that the corporate and political spin doctors are trying to create. But what about when the courts tell the banks they cannot impose punitive charges; is that bad for mum and dad investors as well?

The hoax press release by Jonathan Moylan was designed to highlight the fact that the ANZ Bank says it doesn’t lend money to environmentally harmful projects when in fact it does so regularly.

While the hoax’s impact on ”mum and dad” shareholders was massively exaggerated, the potential power of these shareholders is systematically underestimated. While few Australians own anywhere near enough shares to notice the impact of the daily wobbles in share prices on our incomes, together we all own enough to make most companies do exactly what we want. The challenge is to focus that power through well-crafted motions and to ensure the super funds that manage our money on our behalf are willing to support those motions. The Australasian Centre for Corporate Responsibility will hopefully play an important role in achieving both.

Dr Richard Denniss is executive director of The Australia Institute, a Canberra-based think tank.

“The determination of the movement to protect the Maules Creek community, farmland and Traditional Owners is only getting stronger and I’m confident that determination won’t be broken,” said Jonathan Moylan.

“In 30 years time our children will look back on us and we will have to answer to them,” he said.

Rick Laird, farmer from Maules Creek whose family has farmed in the district for over 150 years, travelled to Sydney to support Jonathan Moylan.

“Jono is a young man of great principle and conviction and we are incredibly grateful for the stand he took to support Maules Creek. We remain determined to fight off Whitehaven’s coal mine to protect Maules Creek and Leard State Forest,” said Rick Laird.

“To most people ANZ is just a bank, but to our community at Maules Creek their loan to Whitehaven Coal threatens to put an end to 150 years of farming in the region.”

“We’ve been fighting this mine for years but what Jono did means the world knows what is happening to Maules Creek farms and the Leard State Forest,” said Rick Laird.

In January 2013 Jonathan Moylan issued a press release on ANZ letterhead saying the bank had withdrawn its $1.2 billion loan facility from Whitehaven’s Maules Creek Coal Project on environmental and ethical grounds. Whitehaven’s share price temporarily fell before quickly recovering.

Moylan was charged under section 1041E of the Corporations Act by ASIC, pertaining to the making of false or misleading statements.

High-resolution photographs are available at: https://www.flickr.com/photos/standwithjono/sets/72157645492344138/

Background

ANZ provides a $1.2 billion loan facility to Whitehaven Coal, primarily intended to develop the Maules Creek Coal Project. The Maules Creek Coal Project is a new open-cut coal mine being developed in Leard State Forest and adjacent farm land near Maules Creek in north west NSW.

On the day of the hoax, Whitehaven Coal’s (WHC) share price dropped from $3.52 to $3.21 before a trading halt, and bounced back to $3.53 within an hour of trading resuming. Since January 2013, Whitehaven’s share price has plummeted in the face of the slumping global coal price, closing at $1.68 yesterday.

Leard State Forest is located between Narrabri and Boggabri, it includes the most extensive and intact stands of the nationally-listed and critically endangered Box-Gum Woodland remaining on the Australian continent. The forest is home to 396 species of plants and animals and includes habitat for 34 threatened species and several endangered ecological communities.

The Maules Creek Coal Project is approved to extract up to 13 million tonnes of coal annually, and is estimated to produce 30 million tonnes of CO2 equivalent per year. The mine is expected to operate for more than 30 years. The coal will be railed from the mine in north west NSW to the port of Newcastle for export. The coal mine project boundary is approximately 5 kilometres from the Maules Creek township. >>

.

[Source: ‘Jonathan Moylan Sentenced to 2yr good behaviour bond by Supreme Court’, 20140725, ^http://www.standwithjono.org/].

It is very good that you publicized both Jonathon Moylan’s heroic stand against Whitehaven Coal and the hypocrisy of ASIC, ANZ Bank and government’s policy – I find it tragic that in spite of the reality that we are part of the natural environment and dependent on its ecosystem services for our livability and very existence and that the value of these services, as estimated by scientists and economists, exceeds by far the gross domestic products of our economy, we still continue to ignore these fundamental truths and prioritize mining, industry and growth over the essential benefits we receive free of charge from the natural environment and its ecosystem services.